You’re financially managing; You may be thriving in some areas but struggling in others.

Follow these steps to help get you on the right track.

Identify your vulnerable areas

Pinpoint some quick financial fixes

Put a long-term plan in place

STEP 1

Identify your vulnerable areas

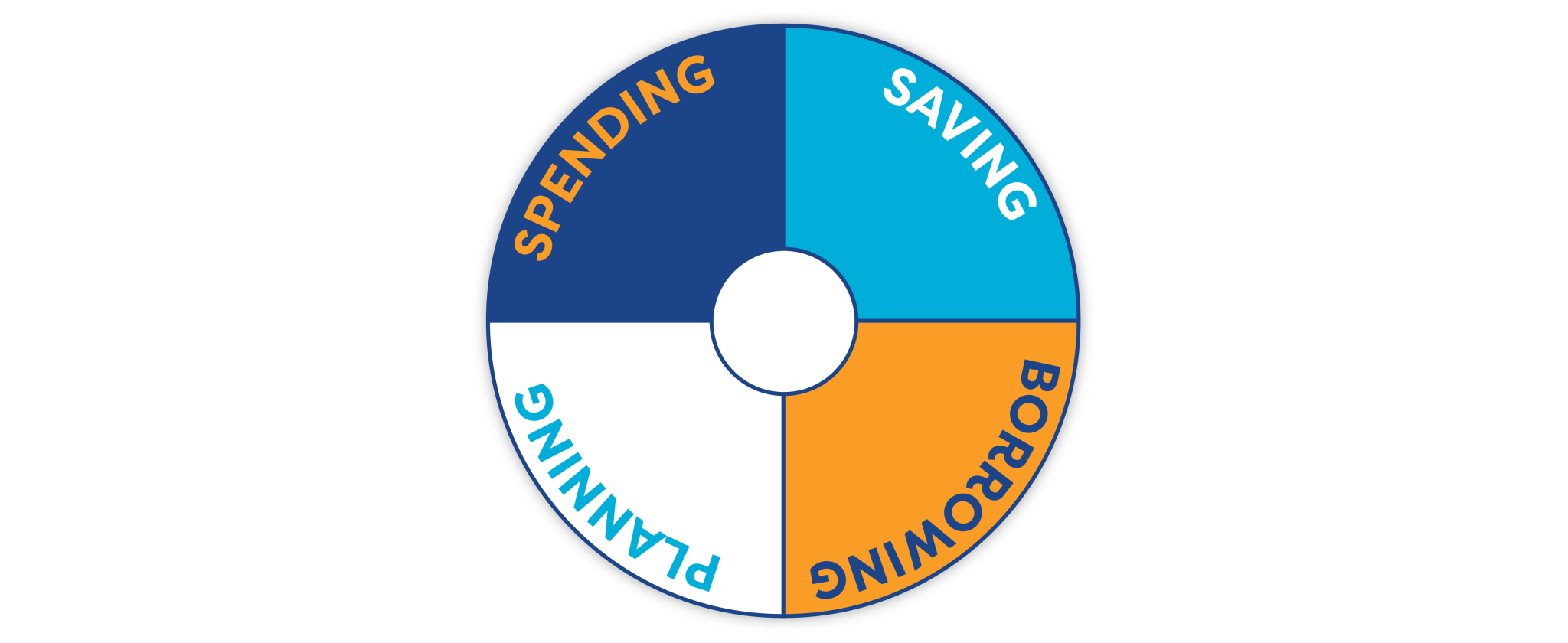

Your financial health score comes from 4 key areas: Spending, Saving, Borrowing, and Planning. Take a look at each area and identify where you need improvement the most.

Spending

Spending less than you make

Paying bills on time

Saving

Ability to cover expenses in the event of an emergency

Meeting goals for long-term savings

Borrowing

Having a manageable amount of debt

Maintaining a good credit score

Planning

Holding adequate insurance policies

Planning ahead for your finances

STEP 2

Pinpoint some quick financial fixes

Once you’ve chosen an area to work on, let’s take some quick actions to gain immediate results. Taking action is the most important step towards success, and even taking small steps can help build momentum towards establishing habits and achieving larger goals. By starting with ridiculously small actions, you can experience quick wins that create a positive feedback loop and motivate you to keep going. Here are some ideas you could start with:

-

- Cancel one monthly service you can do without (Spotify? Hulu? Audible? Billie? We know there’s at least one you can say goodbye to!)

- Tip: Not sure what you are subscribed to? Check out the “recurring expenses” portion of your online banking

- Schedule auto-payment for one of your bills, so you don’t forget to pay it

- Cancel one monthly service you can do without (Spotify? Hulu? Audible? Billie? We know there’s at least one you can say goodbye to!)

-

Put $5 into an emergency fund to kick things off

Tips:- Utilize our “Fill-in-the-Blank” Savings account so your emergency fund is separated from your everyday checking/savings accounts

- Set up an automatic monthly transfer from your checking to a separate savings account

- Set up a Christmas Club Savings account to help with holiday expenses

-

- Make a minimum payment on one of your outstanding debts

- Pay off your smallest debt (get a snowball effect going!)

- Make one extra payment on a loan

- Check your credit score

Tip: View your credit score 24/7 right from your online banking dashboard!

-

- Call your car insurance provider and ensure you have adequate coverage

- Get a life insurance quote

- Make one long-term financial goal to aspire to (Bonus points if you tell a loved one to help keep you accountable!)

STEP 3

Put a long-term plan in place

Once you’ve taken some quick action and seen some immediate results, let’s focus on the big picture.

Make an appointment with an SCCU Financial Specialist!

Membership eligibility required. All loans subject to approval. Your purchase of Superior Choice Debt Protection is optional and will not affect your application for credit or the terms of any credit agreement required to obtain a loan. Certain eligibility requirements, conditions, and exclusions may apply. Please contact your loan representative, or refer to the Member Agreement for a full explanation of the terms of Superior Choice Debt Protection. You may cancel the protection at any time. If you cancel protection within 30 days you will receive a full refund of any fee paid.

Test Modal

Modal Content

Ea rerum vel molestiae omnis molestias. Et ut officiis aliquam earum et cum deleniti. Rerum temporibus ex cumque doloribus voluptatem alias.

Leaving Our Website

You are leaving our website and linking to an alternative website not operated by Superior Choice Credit Union. We do not endorse or guarantee the products, information, or recommendations provided by third-party vendors or third-party linked sites.

Superior Choice Credit Union’s privacy policy does not apply to third-party linked sites. Please consult privacy disclosures on the third-party site.